Why feedback & feature request segmentation is essential for your SaaS product

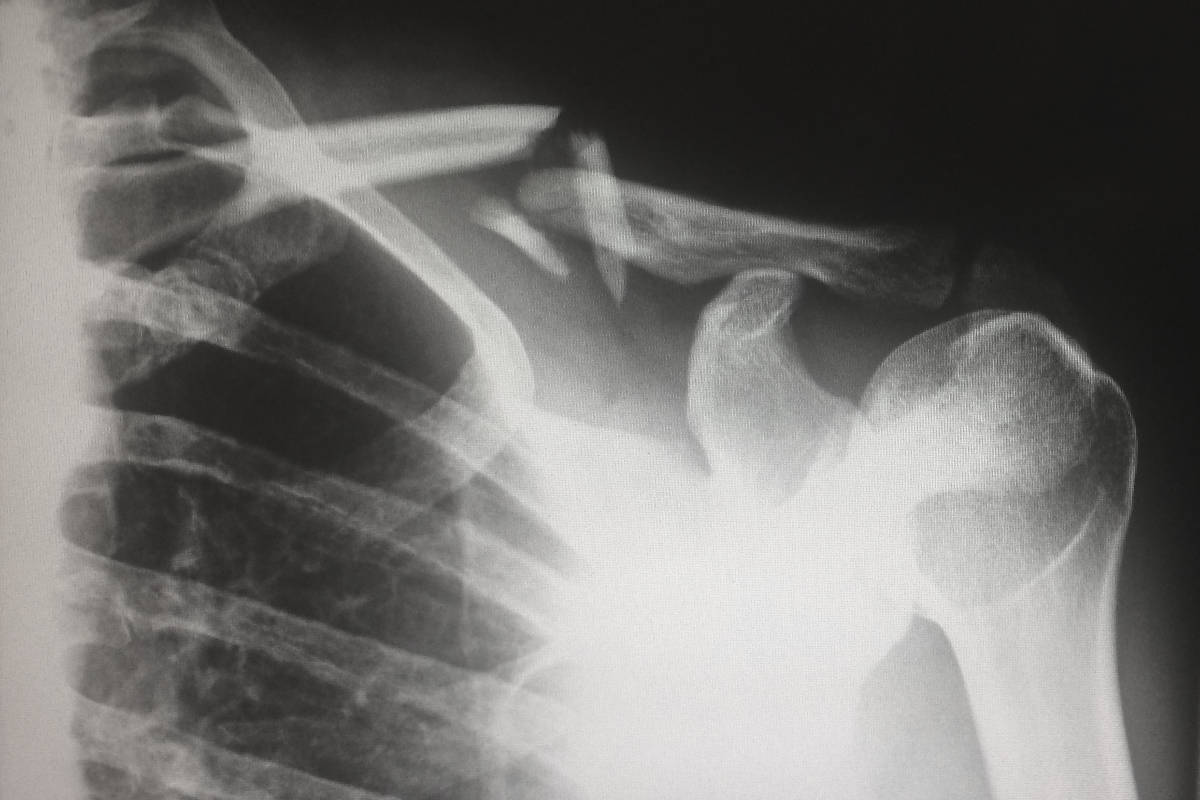

Image credit: Flickr

Image credit: Flickr

What’s wrong with voting on feedback & feature requests?

Nothing. But when done in isolation without understanding of who those votes have come from, you are none the wiser as to which feature requests you should be building. In fact, it can actually have a negative impact on your product. You know that feature with the most votes? The one you hear all the time? How do you know it’s coming from a group you want to listen to? What if that feature is from a swathe of users who are a bad fit for your product or users who have churned? What if the top requests don’t align with the objectives of your company?

At the heart of every SaaS company is the same issue - we all have finite resources but infinite demands on product. You have to get really good at working out which pieces of development will have the biggest impact.

SaaS companies are full of great feedback, product ideas and feature requests but this rich data set is currently untapped. It’s lost in your CRM, support & dev software, held back by a manual processes, in a spreadsheet so massive it takes hours of your product managers’ time to unpick each week and skewed by the dreaded popular vote.

Actually use all that lovely data you have - segment your feature requests

Image credit: Flickr

Image credit: Flickr

The point at which you start to segment your feature requests is when things get exciting and this is at the heart of Receptive’s reporting.

You’re sitting on a gold mine of great feedback and feature suggestions from your customers & internal teams. Introducing segmentation is the start of getting real, actionable data from it all. Let’s take a look at some of the most popular ways to segment your feature requests:

Free triallers

A lot of SaaS companies offer a free trial period. Feedback and feature requests from this group should be handled with care. They are not yet full, paying users of your product and you’re both in the process of working out if you are a good fit for each other. However, this user group can be highly engaged and full of suggestions.

Understanding their prioritised feedback as a group separate from your paying users can be incredibly useful in helping you identify feature gaps or misunderstandings early on. For example, a small messaging change in your marketing can eliminate the need to build some feature: “you won’t need a login for your designer, we automatically create beautiful reports that your clients will love.”

See our previous post on how best to utilise feedback from free triallers.

Churned customers

Churned customers are users who were paying for your product but have now left. During their time using your product, you can guarantee that they will have submitted feedback at some point. It’s impossible to keep track of this communication and even if you can (go you!), the task of going through and removing their input is a painstaking process. As a result, most SaaS companies are counting feedback and feature votes from people no longer engaged with their product.

Separating out churned user feedback stops their feedback influencing product development unless you want it to. You heard me…it’s sometimes good to build features for people who have left! In the same way that free trialler feedback can be of value, the feature requests at the top of of your churned users list might be a signal. Receptive keeps churned users informed when a new feature is released so you can even find that some come back when your feature set matches their needs.

High / middle / low value customers

Most SaaS companies have a price plan model meaning you can segment feedback from customers based on their value. Having this information available can support your product decisions because customers of differing size have different demands on your product. I cannot stress that enough so I’ll say it again…this time in bold…customers of differing size have VERY different demands on your product (see how I threw VERY in there too).

For example, Enterprise customers might want fine-grained permissions so that only certain managers can see the departmental spend on coffee while small customers probably don’t care.

Segmenting based on customer value can help you see where you should be focussing your efforts and help you make decisions that align with the business objectives as a whole. i.e., if your SaaS product is gradually becoming an Enterprise product then you’ll want to put less emphasis on feedback from small users and go for the big wins for your largest customers.

Internal teams

You can’t let customer feedback become the HiPPO in the room which is why understanding feedback and feature requests from internal teams is vital. We recently wrote about this and here’s a snippet from that post:

“In a SaaS company your teams have their own priorities too. Sales, Customer Service, Product Team, Leadership etc…all have insights to bring. Without understanding the needs of your internal teams, you aren’t giving your business the best chance of developing features in a way which fits with the overall strategy of the business. Priorities for your teams are constantly shifting so Receptive allows you to capture this data and get everyone working towards the same goals."

Taking feedback & feature request segmentation to another level

Image credit Flickr

Image credit Flickr

Beyond the basic segmentation described above, every SaaS business will have it’s own unique set of data and objectives. Here’s just a few other ways you can segment feedback & feature requests to give you product management superpowers:

Industry / Market

Many SaaS companies focus on specific markets. By segmenting your feedback, you’ll be able to see patterns of behaviour and which areas of your product are most important to users based on their market. It’s also a great opportunity to focus on feature requests from the markets you want to hear from. These insights enable you to optimise your marketing and pricing for industry-specific segments and cut out those that are less relevant.

Geographical location

Customers in different geographical locations will often have very different demands on your single SaaS product which can be tricky to say the least! We recently helped a business who had one set of customers in a location where they were very forward-thinking while their customer base in another country were happy with a feature set 5 years behind. Segmenting by location gives you a whole new level of understanding into how you can support those users and even if there’s a point you should split your product.

Job role

If you are a B2B SaaS product, you’ll know that users will want different features simply due to their job role so you’ll want to see what’s important to your users from the management team down. Why not split feedback based on job role so you’re focussing your attention on the right people?

Closing thoughts - don’t forget about prioritisation

Segmentation is key in helping you make smart product decisions but the second ingredient to building a great SaaS product is prioritisation.

Segmentation + prioritisation = Real data-driven product decisions

When you get your users to prioritise feedback & feature requests in a dynamic way and combine it with segmentation, you’re on to a frickin’ winner.

Related posts

More about why prioritisation is so important.

Using Receptive for your internal teams